While no tax preparer can actually promise a 100-percent accurate return,

TurboTax can help you create the most correct and beneficial return possible, provided that you enter the correct information. Its guided interface helps you discover the deductions and credits you can claim and what income you need to account for. It can help you to understand the new Affordable Care Act (ACA) and possible penalties and exemptions. Another way TurboTax can help you create an accurate return is by importing your W-2s to eliminate keyed-in inaccuracies. After entering in your information, the tax system selects the best filing option for you.

TurboTax

TurboTax runs thousands of error checks to ensure that your tax return is as accurate as possible. It also guarantees that its math calculations are correct. This software always has the most up-to-date IRS and state tax forms. It can handle all marriage situations, the new health care changes, business taxes, military taxes and more. This tax service was able to catch our intentionally created errors and explained those errors in an easy-to-understand manner.

You can also enter your W-2 information, create your return and file online your return using your mobile device. This year,

TurboTax has introduced a new mobile app for the iOS and Android platforms. Using this app, you can work on your return using any device, including your mobile phone, tablet and computer. To enter your W-2 information using your mobile device, you simply take a picture of your W-2 using your mobile device's camera. Unlike previous mobile versions, which could only file simple tax returns, the new version can help you file other types of tax returns as well.

Ease of Use10/10

TurboTax makes preparing your return as stress free as possible. You do not have to know anything about the new tax laws, tax lingo or tax forms to prepare your returns using this system. It can also handle your state and local tax issues easily. This tax software utilizes a guided-question interface using simple language rather than a tedious form-filling interface. It asks simple questions such as "Were You Married?" and "Did Either of You Make Money in Any Other States?" to help you create a return that fits your specific tax situation.

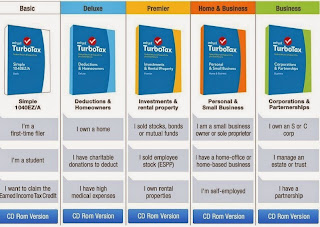

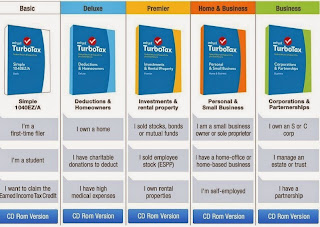

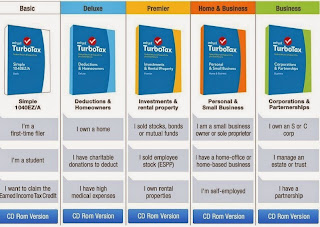

This tax application can easily manage most tax situations, such as extended family situations, rental property, stock sales, moving expense, small business income and more, to cover most common tax scenarios. After entering in your information, the tax system selects the best filing option for you to help you create the most beneficial return. If you have been the type to pay a service to create your returns, even though your tax situation is not overly complicated, you may be surprised how affordable and simple TurboTax to use. You can try TurboTax for free, so it is for sure worth checking out if you have not yet.

Help & Support 10/10

TurboTax provides numerous support options from direct telephone support to community forums. You can also review tax tips and helpful videos to learn more about tax laws that may affect your tax situation. Intuit offers free tax calculators, iPad apps, FAQs, tax estimators and more to help you with your taxes throughout the year. You can also interact with TurboTax via social media, such as through Facebook, YouTube, Twitter and Pinterest. If you are behind, you can use TurboTax to file returns back to the year 2010.

This year, TurboTax has added a feature called TurboTax Benefit Assist. Recognizing the plight of those struggling to meet their basic needs, Intuit has created this tool to help tax payers know if they may quality for government benefits. TurboTax can review your financial information to see if you might quality for things like food stamps, reduced utility bills and more, and then it will help you apply for government benefits you may qualify for.

TurboTax Summary: 10/10

TurboTax has proven that preparing your own taxes does not have to be difficult. Using this online tax software, you can easily create your Federal and State returns accurately. If you should require assistance, adequate support is readily available and simple federal returns can be e-filed for free. Overall, it is the easiest-to-use tax software that we have tested.